Rising Interest Rates Shouldn’t Be Overlooked

Understand this clearly: interest rates are going higher, and this could take a massive toll on the U.S. economy. An economic slowdown could be looming.

You see, for the U.S. economy to continue, you need American consumers. This is a fact. Look at the numbers yourself. If consumers struggle, an economic slowdown follows.

As it stands, thanks to higher interest rates, there are a few things happening that could make life for average Americans very difficult.

Before we go into any details, know that the rates that the Federal Reserve are raising are the most basic interest rates. When they rise, rates across the board usually rise.

Credit Card Interest Rates Soaring

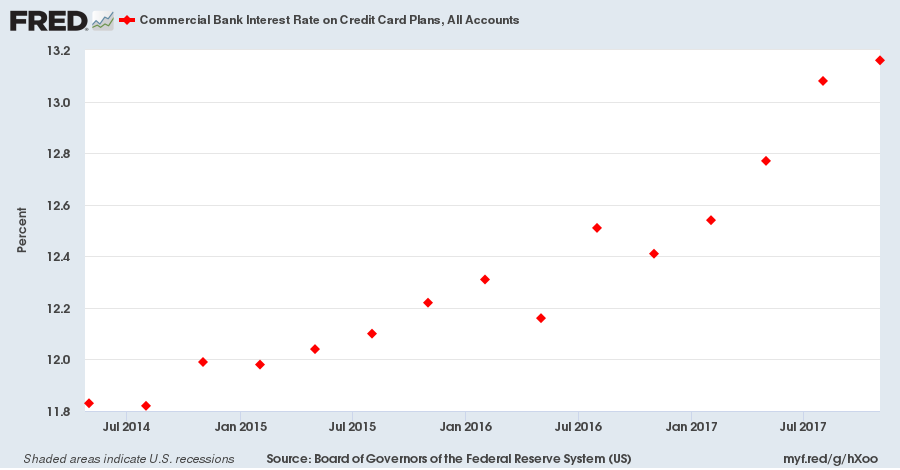

Now, look at the chart below of interest rates on credit cards.

(Source: “Commercial Bank Interest Rate on Credit Card Plans, All Accounts,” Federal Reserve Bank of St. Louis, last accessed January 30, 2018.)

Notice the trend on the chart? Credit card rates are shooting higher as the Federal Reserve is raising rates. These rates are at their highest level since 2011.

Why does this matter?

Keep in mind, Americans have become addicted to credit cards since the so-called “recovery” in the U.S. economy began.

Prior to the financial crisis, the balance for credit card and other revolving plans at all commercial banks in the U.S. amounted to $329.0 billion. Now, this amount stands at $766.09 billion. (Source: “Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks,” Federal Reserve Bank of St. Louis, last accessed January 30, 2018.)

This represents an increase of over 132%. If these rates go higher, Americans could be paying much higher credit card bills.

Mortgage Rates Moving Higher

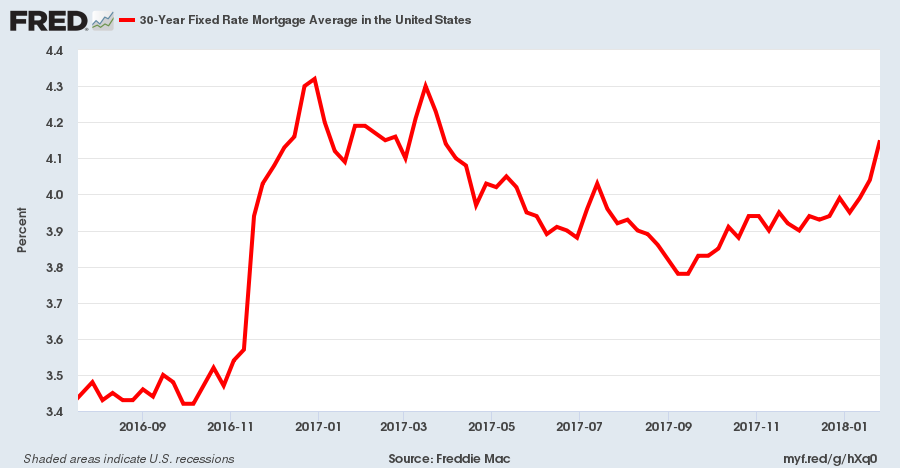

But don’t just stop at credit cards. Look at the mortgage rates.

(Source: “30-Year Fixed Rate Mortgage Average in the United States,” Federal Reserve Bank of St. Louis, last accessed January 30, 2018.)

Mortgage rates are rising as well.

In September 2016, 30-year fixed-rate mortgages were around 3.4%. Now, this rate is 4.15%.

Here’s the thing: mortgage rates going higher could suddenly make homes unaffordable for first-time homebuyers. They could impact homebuilders and the housing market as a whole.

U.S. Economic Outlook: Higher Interest Rates Could Cause Economic Slowdown

Dear reader, I can’t stress this enough: don’t look at the stock market as an indicator of where the U.S. economy could go.

The fact of the matter is, interest rates are soaring. Mind you, don’t just look at what the Federal Reserve is doing; look at how U.S. bonds are reacting too. They are better indicators of where rates for American consumers could go. For example, the 30-year mortgage rates are usually a little higher than the 30-year U.S. Treasury yields.

Now a month into 2018, I remain pessimistic about the U.S. economy. I can’t help but question whether an economic slowdown is nearing. Here’s a bold statement: I will not be shocked if, near the end of 2018, everyone is talking about a recession and how interest rates shouldn’t be rising anymore.